Getting The Hard Money Atlanta To Work

Wiki Article

Little Known Facts About Hard Money Atlanta.

Table of ContentsThe smart Trick of Hard Money Atlanta That Nobody is Talking AboutHard Money Atlanta Fundamentals ExplainedSome Of Hard Money AtlantaHow Hard Money Atlanta can Save You Time, Stress, and Money.Top Guidelines Of Hard Money Atlanta

These tasks are normally completed quickly, for this reason the need for fast access to funds. Make money from the job can be used as a deposit on the following, for that reason, tough money financings allow investors to scale and also flip more buildings per time - hard money atlanta. Provided that the fixing to resale period is brief (generally less than a year), house fins do not need the lasting finances that traditional home loan lending institutions supply.In this manner, the task is able to accomplish conclusion within the set timeline. Standard loan providers might be thought about the reverse of tough money loan providers. So, what is a tough cash lender? Hard money loan providers are typically personal firms or private financiers who use non-conforming, asset-based lendings generally to actual estate capitalists.

Usually, these variables are not the most crucial consideration for funding credentials. Passion prices may additionally differ based on the lender and the bargain in concern.

Hard cash lenders would certainly likewise charge a charge for offering the financing, and also these charges are additionally understood as "points." They usually wind up being anywhere from 1- 5% of the total loan amount, however, factors would normally equal one percent point of the financing. The major difference in between a hard cash lender and also various other lending institutions lies in the authorization process.

Not known Facts About Hard Money Atlanta

A hard cash lender, on the other hand, concentrates on the asset to be acquired as the leading consideration. Credit history ratings, earnings, and other private requirements come secondary. They additionally differ in terms of ease of access to funding as well as rates of interest; tough cash lenders give funding rapidly and charge higher rates of interest as well.You could find one in one of the complying with methods: A basic internet search Demand referrals from local property representatives Request recommendations from actual estate financiers/ capitalist groups Because the loans are non-conforming, you should take your time reviewing the needs as well as terms offered prior to making a computed as well as notified choice.

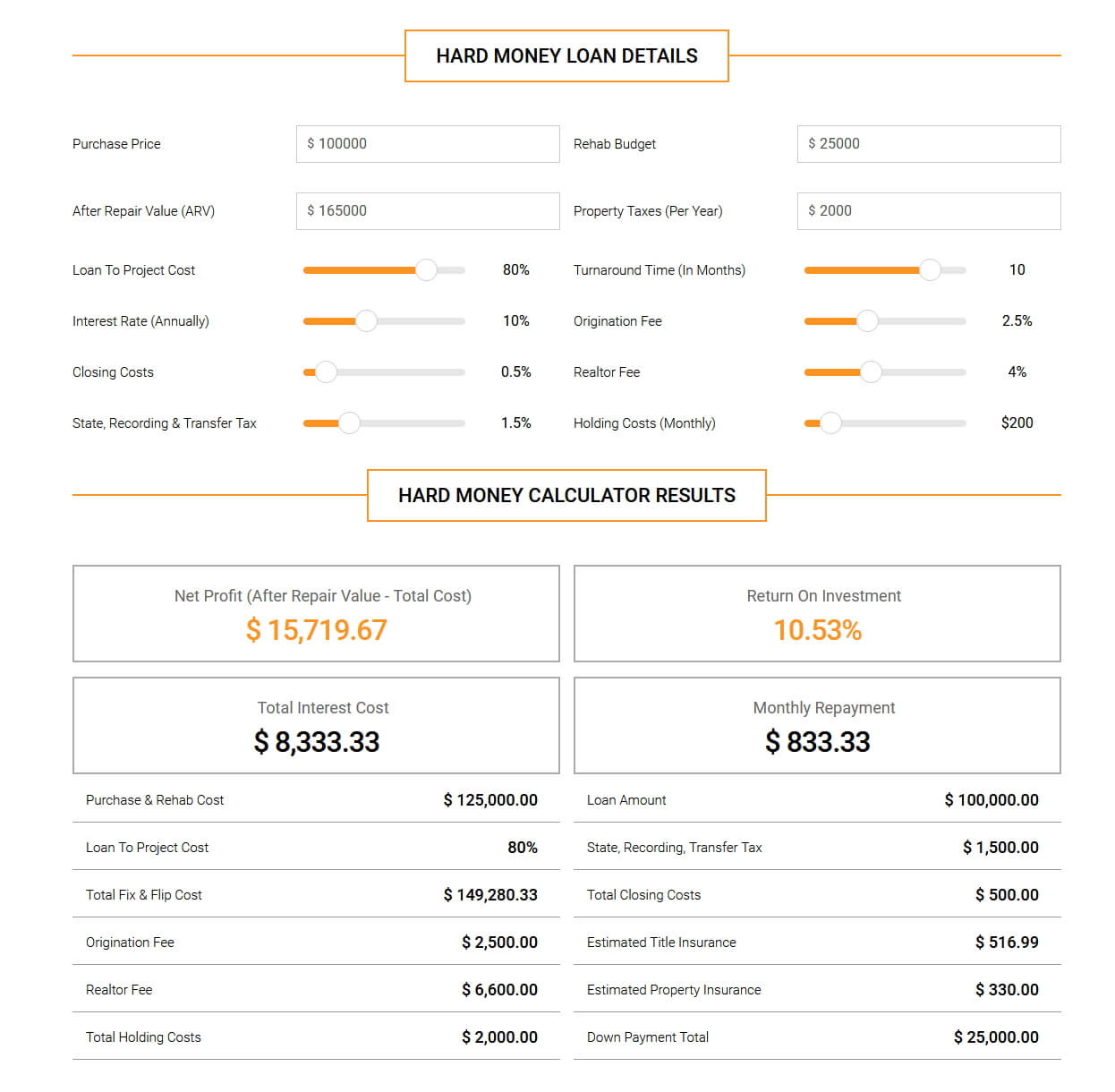

It is necessary to run the numbers before opting for a tough cash loan to make certain that you do not encounter any type of loss. Obtain your tough money lending today and also obtain a loan commitment in 1 day.

A difficult cash finance is a collateral-backed car loan, safeguarded by the genuine estate being acquired. The dimension of the finance is identified by the approximated worth of the home after recommended fixings are made.

Hard Money Atlanta Things To Know Before You Buy

Most hard money lendings have a term of six to twelve months, go now although in some blog circumstances, longer terms can be prepared. The borrower makes a month-to-month payment to the loan provider, usually an interest-only repayment. Right here's exactly how a normal difficult money funding works: The consumer intends to acquire a fixer-upper for $100,000.

Bear in mind that some loan providers will call for even more money in the deal, and also request for a minimum deposit of 10-20%. It can be helpful for the financier to seek the lending institutions that need very little down repayment options to lower their money to close. There will also be the typical title costs connected with shutting a deal.

Make sure to contact the difficult cash loan provider to see if there are early repayment penalties charged or a minimal yield they need. Assuming you remain in the financing for 3 months, as well as the building offers for the predicted $180,000, the financier earns a profit of $25,000. If the residential property sells for more than $180,000, the buyer makes even more cash.

Due to the much shorter term and high interest prices, there generally needs to be renovation as well as upside equity to catch, whether its a flip or rental residential or commercial property. A tough cash lending is suitable for a customer who wants to take care of and also turn an undervalued home within a fairly brief duration of time.

Hard Money Atlanta - Truths

It is essential to understand just how hard cash financings job and also how they vary from traditional finances. Banks as well as various other conventional economic institutions come from most long-lasting fundings as well as mortgages. These conventional loan providers do not typically handle tough cash car loans. Rather, hard cash financings are provided by private investors, funds or brokers who eventually resource the bargains from the private investors or funds.

The 9-Second Trick For Hard Money Atlanta

When using for a tough money funding, borrowers need to prove that they have adequate resources to effectively get with a bargain. Having previous property experience is additionally a plus. When considering just how much money to provide, several hard cash lenders think about the After Repaired Worth (ARV) of the residential property that is, the estimated value of the building nevertheless improvements have actually been made.Report this wiki page